10 reasons why an insurance career is great for millennials

By Liz Aguinaga, August 3, 2022

The insurance industry is a great place to start — and grow — your career. From underwriter to data scientist to claims adjuster, there are jobs for a variety of different skills, and these jobs need to be filled ASAP.

Due to the retirement of baby boomers and industry development, the insurance industry will be hiring 400,000 positions within the next three years, according to The Institutes, a risk and insurance professional development group.

Millennials are the future of insurance, and possess many of the qualities that industry recruiters are looking for, such as an affinity for teamwork, an entrepreneurial spirit and love for solving problems.

Now is an exciting time to work in insurance. If you don’t believe us, trust your peers: According to a 2016 study from insurance technology provider Vertafore, which polled 4,000 insurance professionals between the ages of 19 and 35, more than 80 percent of respondents say they plan to remain in the insurance industry for as long as possible.

Still not convinced? Discover 10 reasons why millennials love working for the insurance industry:

There’s a place for a variety of skills and interests in the world of insurance.

1. There’s a job for your skills.

The scope of the industry goes far beyond the roles of insurance agent and broker. For example, if you have a degree in social science or a background in nursing, you could make an ideal claims professional. Working as an adjuster, appraiser, examiner or investigator taps into these learned skills of communication, empathy and deductive reasoning.

Are you in engineering? You could transfer your creativity, problem-solving, design and scheduling proficiencies to work in loss control or as a risk manager in outside industries such as the public sector, retail, hospitality or gaming. There’s a place for a variety of skills and interests.

The insurance industry has a positive effect on the economy.

2. Insurance careers are sustainable.

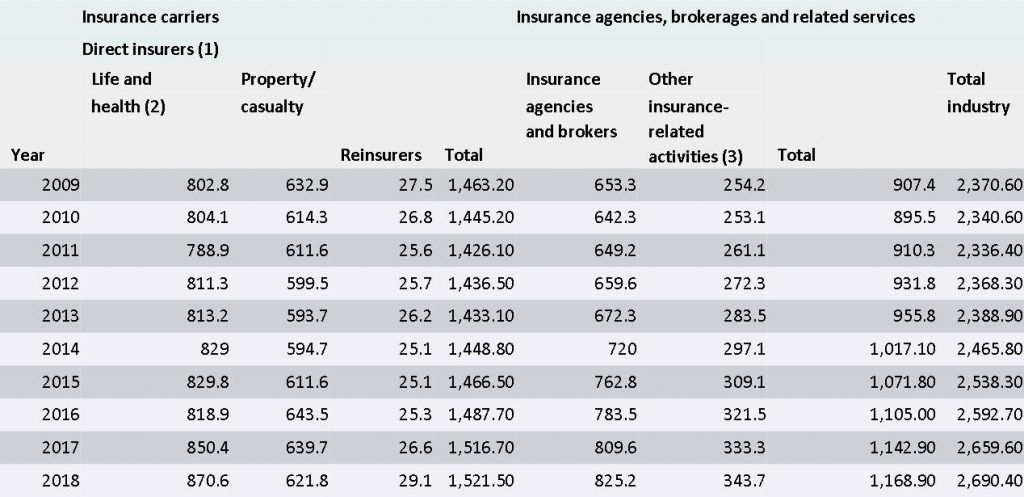

Like death and taxes, insurance has a long history — dating all the way back to 1347 in Genoa, Italy — and its need is a sure thing. According to The Institutes, the insurance industry employs more than 2.3 million individuals in America — that’s 115 times the number of jobs provided by Google, Facebook, Apple, Twitter and Yahoo combined.

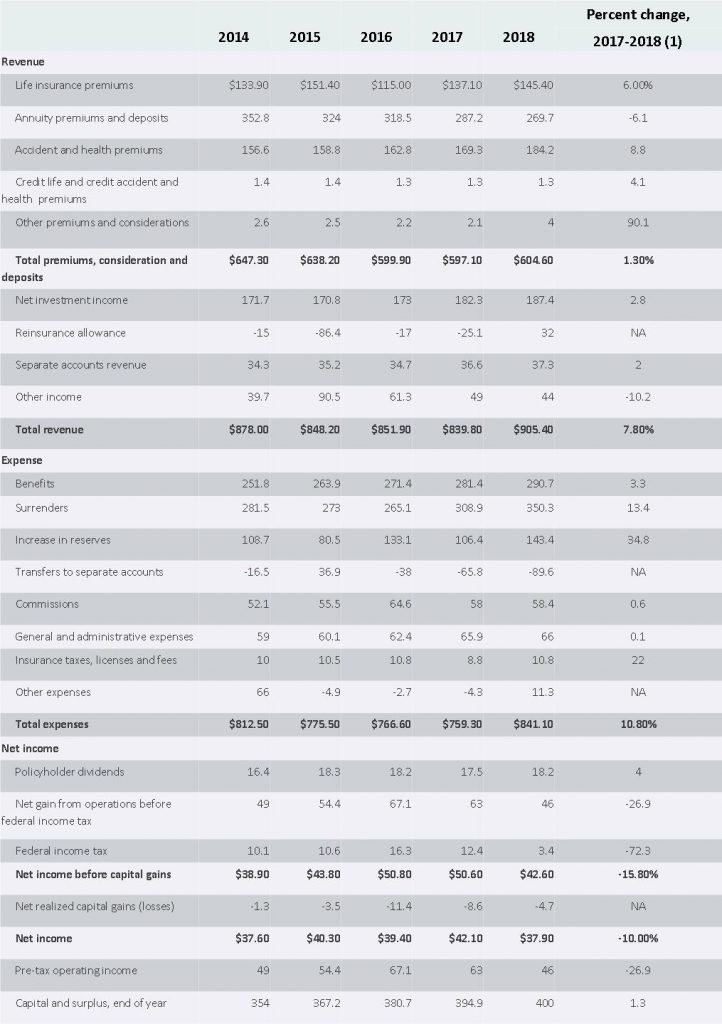

The industry also has a positive effect on the economy, contributing $450.3 billion to the nation’s GDP in 2014, according to the Insurance Information Institute. Just as someone can’t purchase a home without proof of insurance, business owners cannot build or obtain financing for a commercial building without it. And without financing, businesses can’t develop, create jobs or contribute to their communities.

Millennials can exercise their entrepreneurial attitudes in the insurance industry.

3. Career advancement provides opportunities to learn.

Millennials can exercise their entrepreneurial attitudes in the insurance industry, especially in jobs that require creative thinking, problem-solving and a desire to help others. At CNA, for example, there’s a commitment to ensuring your professional development, whether it’s through on-the-job learning, defined courses, self-study or educational reimbursement. We also believe that millennials can further professional growth by volunteering or sitting on the board of a favorite charity, because those learned leadership and communication skills carry over to your career advancement.

Insurance roles entail communicating and collaborating with people from all different backgrounds.

4. Diversity is welcome.

At 87 million strong, millennials are the largest generational group in America, and also the most diverse. Insurance roles entail communicating and collaborating with people from all different backgrounds, and this experience will prove invaluable as the insurance industry expands to writing policies in emerging markets.

In the insurance industry, successful collaboration is important.

5. Teamwork is unavoidable.

Millennials recognize that working together is more efficient than struggling alone. In the insurance industry, successful collaboration identifies business opportunities and solves problems. No matter your role, you will work closely with a range of professionals — inside and outside of your own company.

The insurance industry needs millennials to manage risk related to driverless cars, drones, 3D printers, wearables and the Internet of Things.

6. The work is not boring.

Tech isn’t restricted to Silicon Valley. Now and for the foreseeable future, the insurance industry needs you to manage risk related to driverless cars, drones, 3D printers, wearables and the Internet of Things.

In addition, there’s no “typical day” for insurance jobs. Whether it’s a new client or business risk, each day will bring its own challenges for you to solve.

The insurance industry is looking for millennials — true digital natives — to creatively use technology to solve problems and deliver risk solutions.

7. You will shape what insurance looks like for years to come.

The industry isn’t immune to the pace of change, or consumer demands on commerce, retail and technology. The insurance industry is looking at you — as true digital natives — to creatively use technology to solve problems and deliver risk solutions. In turn, carriers are stepping up innovation to meet the most rapid, large-scale change in our history.

Depending on your position, you may be working in the field to conduct insurance business.

8. Insurance offers a flexible work schedule.

Put it this way: It’s likely your insurance job won’t entail sitting behind a desk 24/7. Depending on your position, you may be working in the field to conduct insurance business. The industry respects millennials’ need to create their own lives, where family, friends, hobbies and work come together in balance.

Insurance is driven by service and is there for people in some of the worst moments of their lives.

9. You’ll make a difference toward the common good.

Insurance is driven by service and is there for people in some of the worst moments of their lives. You will play a role restoring their property or business when catastrophe strikes. After Hurricane Katrina in 2006, insurance companies paid a combined $41 billion to policyholders to help them rebuild.

The property & casualty insurance industry is also driven by charity, donating $575 million in 2014, with the top program areas focusing on education, health and social services, and community needs, according to a report by the Insurance Industry Charitable Foundation and McKinsey and Co.

There’s a place for individuals with a variety of skills and backgrounds to lay down their career goals in the insurance industry.

10. Insurance is everywhere.

The backbones of the world’s economies are unable to exist without insurance. Every construction site, connected device, hospital, shopping center, airport, electrical grid and car is insurance at work — and you played a part in making that happen.

We want you to love working in the insurance industry, just as much as we do! There’s a place for individuals with a variety of skills and backgrounds to lay down their career goals, develop their skills and thrive to become one of tomorrow’s leaders in one of today’s most exciting industries.

Liz Aguinaga is senior vice president and chief officer of Human Resources at Chicago-based CNA Financial Corporation, a provider of insurance solutions. This article first appeared on CNA.com and is reprinted here with their permission.